kansas sales and use tax exemption form

Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Taxes And Import Charges Sales Tax Selling On Ebay Tax

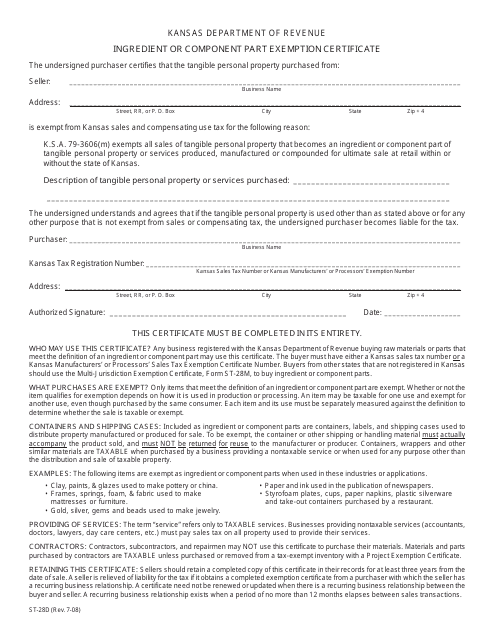

Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Kansas Sales Tax Exemption Form to buy these goods tax-free.

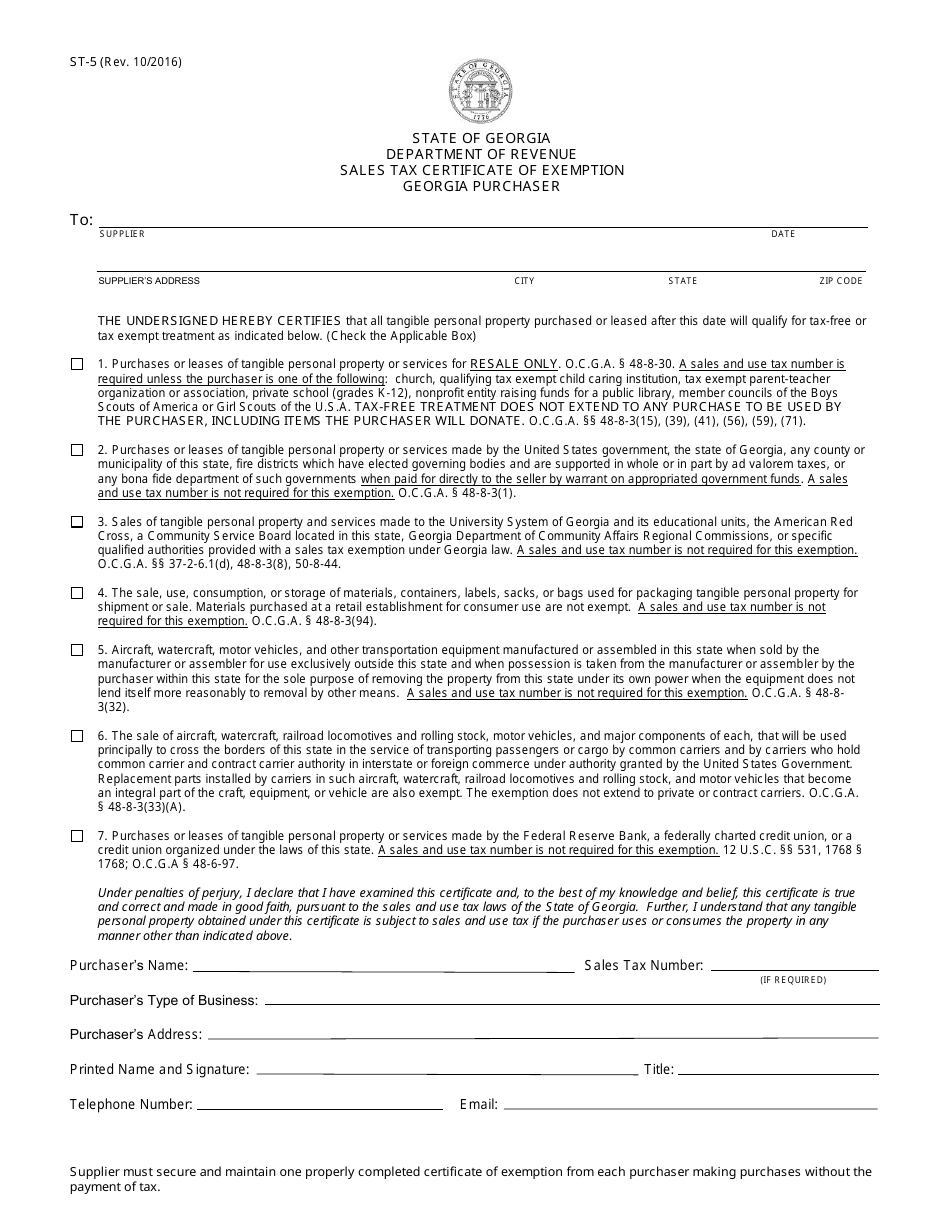

. Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. Or Designated or Generic Exemption Certificate ST-28 Tax Exempt Entity Name. How to fill out the Georgia Sales Tax Certificate of Exemption.

If we have a valid tax exemption certificate on file we will not need to collect sales tax on any items that qualify for the applicable tax exemption. South Carolina SC x. Exemption extends to sales tax levied on purchases of restaurant meals.

OState Exemption from Kansas Sales Tax Tax exempt entity shall present the Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. The Georgia Department of Revenue created a Sales Tax Certificate of Exemption Form ST-5 to make things easier for documenting tax-free transactions.

Creates state and local sales and use tax exemptions for data storage centers and allows municipalities to enter into loan agreements or sell lease or mortgage municipal property for a technology business facility project. Must use YSU Travel Card or University Check. Recent changes in tax law require us to start collecting sales tax from customers in most states unless we have a valid tax exemption certificate on file from the customer prior to the purchase.

While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules and forms. A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold. Address tax rate locator.

This state allows out of state tax exempt entities YSU to use the exemption certificate issued by their home state OHIO Columbus city Present form H-3GOV to have exemption honored. Local sales rates and changes. The claimed exemption must be allowed by Indiana code.

These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic. Make a tax payment. Companies or individuals who wish to make a qualifying purchase.

Copy of prior-year tax documents. Present the Ohio Sales Tax Exemption form to claim sales tax exemption in this state. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Indiana General Sales Tax Exemption Certificate Form ST-105 Form ST-105 State Form 49065 R5 6-17 Indiana Department of Revenue General Sales Tax Exemption Certificate Indiana registered retail merchants and businesses located outside Indiana may use this certificate. Kansas Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Kansas sales tax only applies to end consumers of the product. Tax Policy and Statistical Reports.

File withholding and sales tax online. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. Must enter Vendor Name.

How to use sales tax exemption certificates in Alabama. Keep these notices with this booklet for future reference. Destination-based sales tax information.

144030245 Creates a State and Local sales tax exemption for internet use or. You may also obtain the. Form K-40 is a Kansas Individual Income Tax form.

Present sales use tax exemption form for exemption from state hotel tax. Present copy of Rhode Island Certificate of Exemption PDF Certificate Number 8852 issued January 15 2002. Exempt from Sales and Use tax.

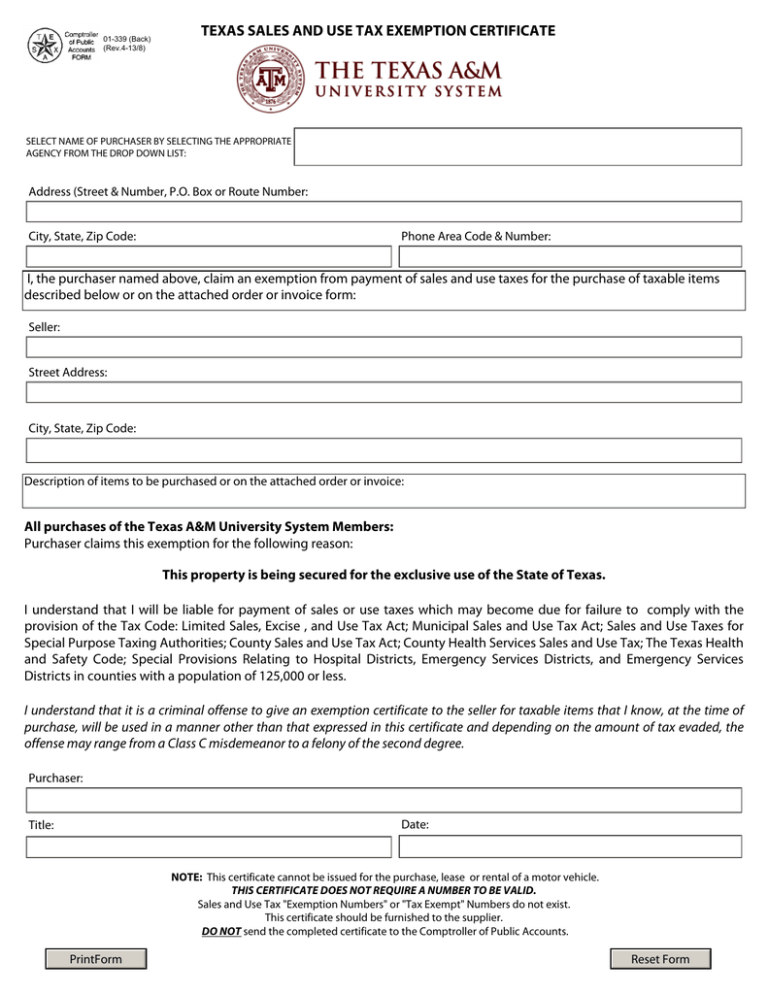

Printable Texas Sales and Use Tax Exemption Certificate Form 01-339-B for making sales tax free purchases in Texas. The redeveloper of the bridge spanning the Kansas River plans to ask the Unified Government for sales tax support to turn the structure into a community gathering space. Filling out the ST-5 is pretty straightforward but is critical for the seller to gather all the information.

Texas Sales And Use Tax Exemption Certificate

Review The Requirements And Process For Obtaining An Employer Identification Number For Tax Employer Identification Number Employment Internal Revenue Service

Reg 256 Fillable Forms Facts Form

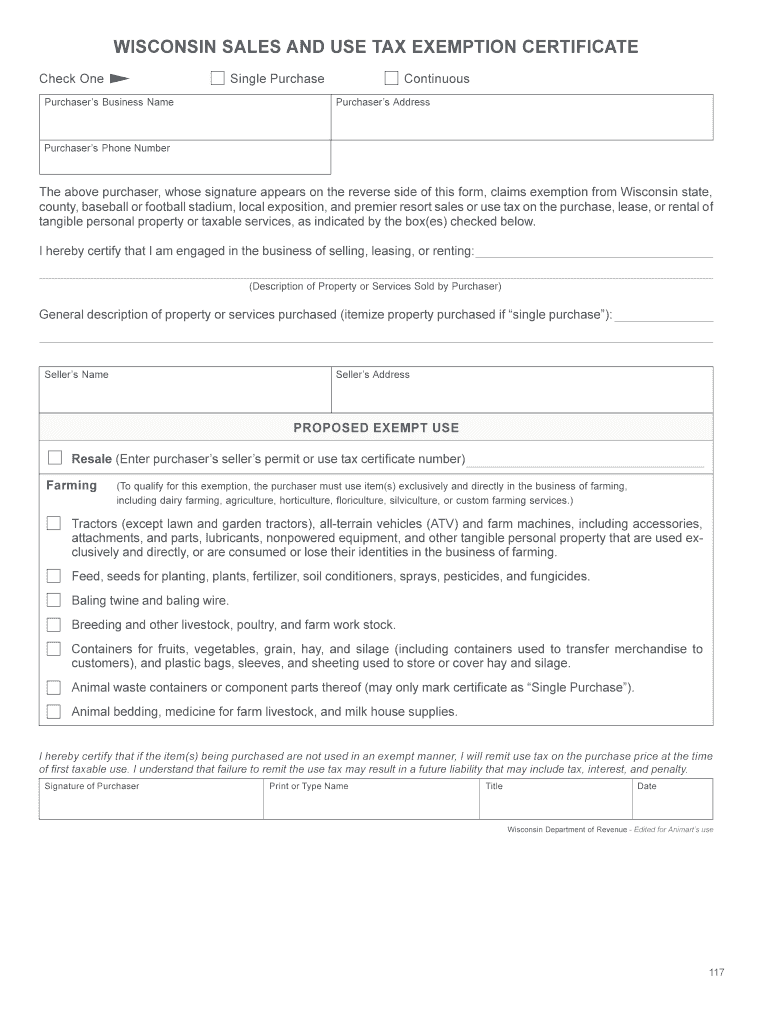

Wisconsin Tax Exempt Form Fillable Fill Out And Sign Printable Pdf Template Signnow

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax

Sales And Use Tax Exemption Letter How To Write A Sales And Use Tax Exemption Download This Sales Letter With Use Of Ta Tax Exemption Lettering Sales Letter